* Results of a new poll on raising the cigarette tax by a buck a pack has generated some coverage…

Of the 502 people surveyed by the Illinois Coalition Against Tobacco, 74 percent said they support raising taxes on cigarettes by $1 — from 98 cents per pack to $1.98 per pack.

Despite the public support, a measure to raise cigarette taxes is about 10 House votes shy of approval, said Rep. Karen Yarbrough, D-Maywood.

* I asked for the toplines and received all but one of them. Check out the “right track/wrong track” numbers when respondents are asked how they “think things in your area of Illinois are generally headed”…

Right Direction 23%

Wrong Track 64

Don’t Know 13

That ain’t great. Sure would like to see the regional crosstabs.

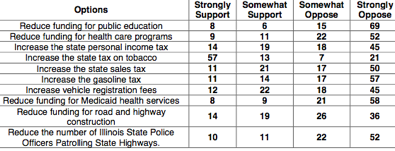

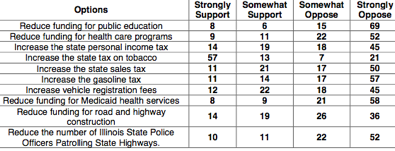

* Next question: “Now, as you may know, Illinois is facing a significant budget deficit, estimated to be over thirteen billion dollars. I’m going to read several options that have been proposed to help address the budget deficit. After each one that I read, please tell me if you would Support or Oppose that option to help reduce the state’s budget deficit…

[Click the pic for a larger image.]

Notice that huge majorities are opposed to service cuts and an income tax hike, but 70 percent say they could back increasing the tobacco tax.

* There ain’t much downside for candidates on this issue, either. Here are the results from a question about whether respondents would be more or less likely “to support candidates for state or local public office in Illinois if you knew that they supported raising the Illinois Cigarette tax by one dollar per pack”…

Much More Likely 15

Somewhat More Likely 14

Somewhat Less Likely 3

Much Less Likely 8

No Difference 58

Don’t Know 2

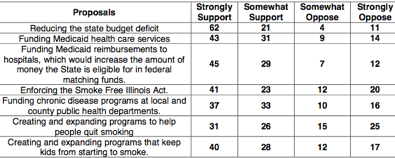

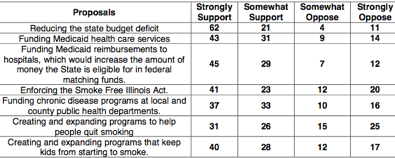

* And here’s what happened when they were asked how they wanted the money from a new cigarette tax to be spent. Again, click the pic for a larger image…

* Some internals from the cig tax hike question via the pollster’s memo…

• Support for the tax is similar in all areas of the State, including Chicago (76% support), the Cook County suburbs (72% support), the collar counties (75% support), North (74% support) and South (70% support).

• Voters < age 50 (74% support) and age 50+ (73% support) hold similar opinions. This remains consistent among men and women, with a noticeable upward spike in support among women under age fifty (80% support, 70% strongly).

• Support is high among white voters (71%) and minorities (82%).

• Those with college degrees are strongly in favor of the tax (79% support) while support is high among those without degrees (69%). Those making < $75k per year are as supportive as all voters (71%) while those making more than $75k per year are strongly in favor of it (81%).

• Republicans (71% support) and Independent (68%) voters are solidly in favor of the $1 per pack increase, with Democrats even more supportive (81%). This pattern of strong support among partisans remains consistent among liberals (76% support), moderates (79% support) and conservatives (68% support).

• Even four of ten (42%) smokers support the tax. [Emphasis added.]

That last point is kinda fascinating.

* 80 percent said they supported “taxing other tobacco products such as cigars and smokeless, or chew tobacco at comparable rates as cigarettes” and 77 percent said they were concerned “about smoking and other tobacco use among young people in Illinois.

* Methodology…

The Campaign for Tobacco Free Kids commissioned the survey. Fako & Associates, Inc., of Lisle, Illinois conducted the survey by telephone on April 5 - 7, 2010 using professional interviewers. F&A interviewed a random sample of 502 registered voters that are likely to vote in the November 2, 2010 General Election in the State of Illinois. A strict screening process was used to ensure that only likely voters in the November 2010 General Election participated in the survey. The interviews lasted an average of 10 minutes. Scientific sampling techniques using a listing of registered voters were used to give all registered voters living in a telephone-equipped household within the State an equal chance of being interviewed. The interviews were conducted in proportion to gender and regional shares of the vote based on past election data and known demographics. Weighting was applied to age to bring this group closer into proportion with known demographics. The survey has a margin of error of +/- 4.32% at the 95% level of confidence. This means that if the survey were replicated the results would be consistent for 95 out of 100 cases. The margin of error is higher among the various sub-groups.

Thoughts?

- Pot calling kettle - Friday, Apr 16, 10 @ 11:55 am:

The voters have spoken. They want their services, but they don’t want to pay for them. Go figure.

- Independent - Friday, Apr 16, 10 @ 12:02 pm:

When we hear condemnation of “do-nothing politicians” we need only look at surveys like these and realize our politicians merely reflect ourselves.

- MOON - Friday, Apr 16, 10 @ 12:15 pm:

The results of the poll are not surprising. I do not know for a fact, but I assume 75 plus or minus percent of those polled are not smokers. Thus, they are all for raising taxes on the 25 plus or minus percent who do smoke.

Its the same old story “provide me with all the benefits but tax the other guy and “.

- wordslinger - Friday, Apr 16, 10 @ 12:22 pm:

Tobacco is the true wacky weed. We subsidize growing it, tax the heck out of it, spend millions telling people not to smoke it, then spend billions more on its health costs.

- conda67 - Friday, Apr 16, 10 @ 12:24 pm:

Hello black market

- winco - Friday, Apr 16, 10 @ 12:27 pm:

It shocks me that Medicaid is the most popular service/least desirable cut. I think that is an indicator that many people don’t know the difference between Medicaid and Medicare. In other words, if they asked: “Should we cut healthcare for poor people,” then more than 17% would say yes. (I would not be one of them, for the record).

- Peggy SO-IL - Friday, Apr 16, 10 @ 12:29 pm:

I echo Pot-c-Kettle: The people have their hands out, but want smokers to pay for it all. Did they poll only non-smokers?! [I see in methodology, they did not, of course. But, it’s interesting that the support for tobacco taxes is so strong.]

- shore - Friday, Apr 16, 10 @ 12:33 pm:

taxing alcohol wouldn’t hurt my feelings either. I’m against sales taxes only because I don’t see why a 4th grade teacher should pay the burden of the ceo of boeing. What I think would be good would be if you have to do it taxing things that are huge luxury items like sky boxes at stadium events, tuxedos, liquor, limosuines, bottle service (a john kass favorite) which are hard to argue against politically (who wants to have an ad saying that xyz politician voted against raising taxes on limos and cigars so that your kids teacher could get fired) and which aren’t going to hurt most people.

- Plutocrat03 - Friday, Apr 16, 10 @ 12:35 pm:

Classic push poll which leads to the ‘logical’ answer the polling organization has designed the poll for.

In these times, selling the fairy-tale that ‘everyone’ suffers the consequences of losing something fluffy and desirable, but a marginalized group (smokers in this case) can be burdened with a tax, or restrictions to ’save’ the program is the pablum the politicians use to push stupid stuff.

Regardless whether Milton Friedman or Rober Heinlein said it first, there is no such thing as a free lunch. Until the public becomes sufficiently educated to that fact, the pols will collect the public’s money and enrich themselves and their friends while doling out crumbs to those who really need the help.

- at the press conference - Friday, Apr 16, 10 @ 12:35 pm:

Actually, 42% of smokers were in favor of the $1/pack cig tax increase

- shore - Friday, Apr 16, 10 @ 12:36 pm:

property sales over 1 million dollars, expensive technology, 1st class airfare,

- Rich Miller - Friday, Apr 16, 10 @ 12:37 pm:

===42% of smokers===

And that’s in the (admittedly long) post.

- Rich Miller - Friday, Apr 16, 10 @ 12:39 pm:

===Classic push poll===

For the higher cig tax support, there is a bit of a push. But for the initial cig tax number, there’s not much of a push except a reminder about the state deficit.

- Baltimoron - Friday, Apr 16, 10 @ 12:46 pm:

Don’t forget Illinois currently rank #32 in the amount of our state tax on cigarettes. There are 31 states that tax it higher, including Wisconsin, Michigan, Iowa and Indiana. So it’s not exactly cruel and unusual punishment. Those 4 out of 10 smokers who supported are probably the four in ten who are trying to quit. This might help them succeed.

- El Conquistador - Friday, Apr 16, 10 @ 12:57 pm:

If you’re looking at gov’t cost reductions that will have significant budget and extremely limited pubic service implications, I suggest eliminating DCEO. Their budget is roughly $2.4 billion. Do away with this agency and you’re good in 4 years doing little else in the way of cuts. Any real function performed by DCEO could easily be transferred to another (if there is any).

It’s well known that DCEO is the sycophantic political arm of the Governor’s Office. Largely, DCEO gives out money and attaches itself to the shiny object issues of the day. Check out their org chart. It’s filled with SPSA’s having one PSA report to each.

Now that the budget crisis has been resolved. What’s next?

- Rich Miller - Friday, Apr 16, 10 @ 12:58 pm:

===Do away with this agency and you’re good in 4 years doing little else in the way of cuts.===

That’s Tribune editorial board math.

- matt - Friday, Apr 16, 10 @ 1:08 pm:

Ugh. Cigarettes in Chicago are already pushing $10 a pack. Any higher and I’m sure it would be the highest in the country, if it isn’t already.

For the rest of the state with their cheap cigarettes, an increase would be fine. But its already ridiculous in Chicago. I do have some issues with the regressive nature of these taxes.

- BIG R.PH. - Friday, Apr 16, 10 @ 1:17 pm:

How much more business do we need to chase out of the State?

We are currently #30 in cigarette taxes but if we put an additional $1 on we will now be #12. And we will be $1.02 higher than Indiana. We will be $1.82 higher than Missouri. We will be $0.99 higher than Indiana. We will be $1.38 higher than Kentucky.

When will politicians wake up?

Illinois is NOT an island 500 miles away from our nearest competitor.

People will do WHATEVER they have to do to avoid paying a tax. (see the Tea Party Movement)

The amount projected by any taxing body that will actually be gained by the taxing body is usually about half. (see bottled water in Chicago)

How about this. Lower the Corporate Taxes in Illinois. This will attract employers who need employees to work. This will generate more in taxes than a tax increase.

- ILPundit - Friday, Apr 16, 10 @ 1:26 pm:

El Conquistador –

Over $2 billion of the FY 11 DCEO budget comes from Federal Funds. Another $300 million comes from other state funds.

Only $44 million of the DCEO budget is state GRF.

So congratulations, you’ve come up with a proposal that eliminates less than half of one percentage point of the total state budget deficit.

Great work. (/sarcasm)

- L.S. - Friday, Apr 16, 10 @ 1:44 pm:

Taxing cigarettes out of existance doesn’t solve much of the problem. Of course it polls well, it’s the only option that doesn’t affect the majority of respondents. And, for that same reason, it’s not the answer. All my Chicago friends who smoke are already taking turns making runs for cartons to NW indiana or Will County.

- Pelon - Friday, Apr 16, 10 @ 2:12 pm:

A $1 cigarette tax increase would raise about $300 million. We’d only have $12.7 billion to go.

“Don’t raise my taxes, and don’t cut my services.” - Roman citizen circa 410 AD

Pingback Poll: Big support for cig tax hike, most oppose service … - The Capitol Fax Blog | Review Smokeless Cigarettes - Friday, Apr 16, 10 @ 2:22 pm:

[…] Original Post By Google News Click Here For The Entire Article Electronic Cigarette Review- […]

- steve schnorf - Friday, Apr 16, 10 @ 2:31 pm:

More proof of the great insight Pogo had 40 years ago.

I wish they had added a question like “Wish on the evening star for the good fairy to give us some money” to see how that would have polled.

- The Mad Hatter - Friday, Apr 16, 10 @ 2:44 pm:

Sheesh Rich. Delete this story. i thought you didn’t print blatantly biased articles like this. The poll was conducted by an anti-smoking group. How did you think the results would look? It would have been news if the poll showed people were opposed to a tobacco tax increase. What’s next? A story from the American Kennel Club that shows people like dogs more than cats?

- Rich Miller - Friday, Apr 16, 10 @ 2:46 pm:

===The poll was conducted by an anti-smoking group.===

Wrong. It was conducted by Fako for an anti-smoking group and it’s clearly marked more than once.

- El Conquistador - Friday, Apr 16, 10 @ 3:19 pm:

ILPundit - If you dig a bit deeper, I believe you’ll find that DCEO’s “federal funding” (or simply not GRF) comes from it siphoning both state and federal funds from many other agencies. Unless there’s a huge federal DCEO block grant I’m not aware of…

I agree their GRF dependency is relatively small. However, if DCEO were not draining funds from agencies providing direct public services, the whole of state gov’t would be fairing much better. According to your breakdown, about $2.1 billion better.

- ILPundit - Friday, Apr 16, 10 @ 3:53 pm:

El C-

Federal funds are exactly that — money for programs funded either in whole, or in part, by the federal government. These are not funds that can be used for anything other than what the Federal Government deems they can be used for. Period.

Put simply, DCEO could eliminate its entire $2.0 billion federal funding supplement — and the impact on the current budget deficit would be zero. You would cut a lot of programs, but you wouldn’t actually save any money for the state — you’d only be saving money for the federal government.

In other words, you are effectively advocating for Illinois to cut federal programs so that Washington DC can send that money to other states (like Iowa) — all so that you can accomplish literally nothing to help our current fiscal crisis.

Brilliant!!!!

- El Conquistador - Friday, Apr 16, 10 @ 4:18 pm:

No, I’m advocating for the elimination of DCEO with all federal and state funds they rely upon to be utilized and/or distributed by core service providing agencies. At no point did I say the funds aren’t needed or would not be spent. I indicated they could be much better utilized by primary service providing agencies and to off set their funding shortfalls.

- ILPundit - Friday, Apr 16, 10 @ 4:28 pm:

Great — then you saved a total of $44 million dollars. Congratulations. You’re a winner.

- ILPundit - Friday, Apr 16, 10 @ 4:30 pm:

Because…and I repeat myself here…the Federal funds cannot be re-purposed, they would only be returned to Washington DC.

If you passed a state law to re-purpose the money from other state funds, you would free up no more than $340-350 million. Again, a drop in the bucket.

- Reformer - Friday, Apr 16, 10 @ 9:04 pm:

I wonder if any tea party members support this tax hike? I thought they opposed higher taxes.

- Reformer - Friday, Apr 16, 10 @ 9:07 pm:

Baltimoron:

It’s true our state tax isn’t high, but Illinois allows local gov’ts to pile on, unlike some states. Cook County, with more than 40% of the state’s population, has a $2 a pack tax, while Chicago adds another 65 cents. In the county of Cook, in other words, we have one of the nation’s highest taxes on cigarettes.